As I learn more about finances, I'm realizing just how much there is I need to know. I recently learned one big lesson the hard way and it's been an interesting pill to swallow.

When I left my last job in April, I had a 401K with that company. They had matched 3% to the 6% I contributed so it was sitting just under $6,000.

I regularly saw that money on my Mint account and loved that tiny investment portion of my finances. Even after sitting down with 2 financial advisers, I didn't realize I had to do something with that money after leaving the company. However, when I recently logged into my account, there was a notice that said I hadn't taken action on my 401K after 6 months of not being employed with that company so the account would be liquidated.

Oh.

Apparently I was supposed to roll it over into an IRA if I wanted to keep the funds for retirement. I guess that makes sense because I wasn't vested with my company so they couldn't keep their match tied up with me when they could get it back. I just didn't know and admittedly didn't make the effort to learn.

So after the company match, taxes, and the 10% fee were removed, I had a check for about $3,000 in my hand. It bums me out that I don't have that money for retirement anymore and come to think of it, I could have just re-invested it. But I didn't.

Debt has obviously been a big struggle for me and it was my first instinct to knock out $3,000 worth of debt with that money. And that's exactly what I did. At the unfortunate sacrifice of retirement, I'm happy to announce I will be ending 2014 completely credit card debt free.

Going forward, I will also be working to save towards retirement because now I'm really

behind. I have been with my current company for 6 months now, which

means I am eligible for a 4% match that is 100% vested at the start of

the new year. I will take advantage of that and the rest of my extra income will still go towards debt repayment.

It is a huge relief to kick off 2015 with a financial focus on student loans. I felt incredibly guilty having credit card debt because it's obvious proof of not spending wisely despite the mountain of student loans I have. As the spending challenge continues, I want my hard work to reflect smart spending habits.

Thursday, December 11, 2014

Monday, December 1, 2014

Spending Challenge: November Totals

November 1st Balances

Amex:$1,545.79 $0

Mastercard:$5,714.27 $3,760.59

Sallie Mae:$14,123.57 $11,472

Chase: $19,907.33

Sallie Mae: $24,754.52

December 1st Balances

Amex:$1,545.79 $0

Mastercard: $5,714.27 $3,646.73

Sallie Mae:$14,123.57 $11,451.11

Chase:$19,907.33 $19,723.04

Sallie Mae: $24,754.52

That's a total of $113.86 this month...

Now, I know that sounds like a teeny tiny number, and it is, but it's not exactly representative of what actually happened in November. There were 2 very large car expenses (taxes and maintenance for the new car) that I put on my credit card. I have the money to pay myself back, it just hasn't gone through yet. So when you see the totals for December, it will be drastically different.

I still worked hard, earned extra money and stuck to the spending challenge. I babysat, wrote resumes, did 2 freelance research projects, earned a small bonus at work, worked on Gradible.com, dog sat, and stuck to the spending challenge rules to make this possible.

The hardest part about the challenge this month was:

Having my friend Jessie and her fiance visit. Of course I LOVED seeing her and I don't regret spending a little extra money on hosting her. I did some extra grocery shopping to feed them and we went out to eat a bit. It wasn't a huge budget buster but it did go over. I knew she was coming with plenty of notice so I could have planned better.

What I learned from the challenge this month was:

If you need to get a book for book club and you're 168th on the hold list at the library, check out the large print version. I was only 6th in line and I already have the book. Yes, there's an extra 200 pages because the text is so big but I didn't have to buy the book!

I also learned that you have to do something with your 401K within 6 months of leaving a company. More on that in another post.

Lastly, I learned that sticking to a budget your comfortable with is crucial, especially with big purchases. I could have justified buying a fancy 2013 car but I would have been car poor. Considering cars are never an investment, I'm so glad I found a better deal. If you're not finding a deal you're comfortable with, keep waiting. It will happen, you just have to wait and dig a little deeper.

The best part about the challenge this month was:

Budgeting for stuff I'm allowed to buy. Living in Minnesota, we got hit with some snow early in the month and it was time to buy winter boots. Rather than treating it like an unexpected expense and putting it on my credit card to "pay off later," I was prepared and didn't feel guilty about making the purchase. Better yet, I was smart and more thoughtful about what I bought. I usually buy Uggs, which are warm but not waterproof. Instead, I went with Sorel boots at the same cost. They are more sturdy, waterproof, and will last for many more years.

3 months down, 9 to go!

Amex:

Mastercard:

Sallie Mae:

Chase: $19,907.33

Sallie Mae: $24,754.52

December 1st Balances

Amex:

Mastercard:

Sallie Mae:

Chase:

Sallie Mae: $24,754.52

That's a total of $113.86 this month...

Now, I know that sounds like a teeny tiny number, and it is, but it's not exactly representative of what actually happened in November. There were 2 very large car expenses (taxes and maintenance for the new car) that I put on my credit card. I have the money to pay myself back, it just hasn't gone through yet. So when you see the totals for December, it will be drastically different.

I still worked hard, earned extra money and stuck to the spending challenge. I babysat, wrote resumes, did 2 freelance research projects, earned a small bonus at work, worked on Gradible.com, dog sat, and stuck to the spending challenge rules to make this possible.

The hardest part about the challenge this month was:

Having my friend Jessie and her fiance visit. Of course I LOVED seeing her and I don't regret spending a little extra money on hosting her. I did some extra grocery shopping to feed them and we went out to eat a bit. It wasn't a huge budget buster but it did go over. I knew she was coming with plenty of notice so I could have planned better.

What I learned from the challenge this month was:

If you need to get a book for book club and you're 168th on the hold list at the library, check out the large print version. I was only 6th in line and I already have the book. Yes, there's an extra 200 pages because the text is so big but I didn't have to buy the book!

I also learned that you have to do something with your 401K within 6 months of leaving a company. More on that in another post.

Lastly, I learned that sticking to a budget your comfortable with is crucial, especially with big purchases. I could have justified buying a fancy 2013 car but I would have been car poor. Considering cars are never an investment, I'm so glad I found a better deal. If you're not finding a deal you're comfortable with, keep waiting. It will happen, you just have to wait and dig a little deeper.

The best part about the challenge this month was:

Budgeting for stuff I'm allowed to buy. Living in Minnesota, we got hit with some snow early in the month and it was time to buy winter boots. Rather than treating it like an unexpected expense and putting it on my credit card to "pay off later," I was prepared and didn't feel guilty about making the purchase. Better yet, I was smart and more thoughtful about what I bought. I usually buy Uggs, which are warm but not waterproof. Instead, I went with Sorel boots at the same cost. They are more sturdy, waterproof, and will last for many more years.

3 months down, 9 to go!

Monday, November 17, 2014

The time brunch fixed everything

Two weekends ago I went out to the Lyndale Tap House for brunch with two of my favorite friends. I had a Groupon from an old birthday present so that made it even sweeter. As we were brunching, we were talking about needing to buy cars, because both my friend and I were looking for a new one.

My friend, Jamie, is from Illinois and is not a great driver (self-proclaimed), especially in the MN snow. She has a 2008 Ford Focus and wanted something more heavy duty with all-wheel drive. As I listened, I had a light bulb moment. I should buy her car.

I asked her 20 questions and found that there's only 75,000 miles on it. It has remote-start. It has some cool stereo bells and whistles. It gets great gas mileage. And she was simply hoping to trade it in to the dealer for whatever they will give her. Even by paying more than the dealer, I was still going to get a great deal!

Jamie even took the car to a mechanic to make sure everything checked out. The brakes need some work and we agreed to split the cost. This deal couldn't have gone more smoothly!

Best of all, it was much closer to my comfort zone of a car payment. Yes, I would still need a loan but it would be much more affordable than something much newer. And car insurance would be more affordable too. What a huge sigh of relief!

Since I wasn't needing such a high loan, I was approved for the $6,500 I was looking to take out, despite my credit issues. Technically I paid $5750 for the car but I had to consider taxes and fees, fixing the brakes and few maintenance expenses. The dealer was willing to give her roughly $5,000 at best and the car values at up to $8,000.

So without further adieu, I am pleased to introduce you to my new car!

Meet Lloyd Christmas! Fitting name, as he is my Christmas present to myself, he's red, and Dumb and Dumber is one of the funniest classics of all time :)

Now Jamie is thrilled with her brand new Chevy Equinox and I am loving Lloyd. You can even imagine us doing a happy dance, jumping around the Chevy parking lot when we both got new cars!

It really was the best deal I could have found and I plan to run this car for as long as it will last. Now to navigate selling my old car and continuing with the spending challenge!!

My friend, Jamie, is from Illinois and is not a great driver (self-proclaimed), especially in the MN snow. She has a 2008 Ford Focus and wanted something more heavy duty with all-wheel drive. As I listened, I had a light bulb moment. I should buy her car.

I asked her 20 questions and found that there's only 75,000 miles on it. It has remote-start. It has some cool stereo bells and whistles. It gets great gas mileage. And she was simply hoping to trade it in to the dealer for whatever they will give her. Even by paying more than the dealer, I was still going to get a great deal!

Jamie even took the car to a mechanic to make sure everything checked out. The brakes need some work and we agreed to split the cost. This deal couldn't have gone more smoothly!

Best of all, it was much closer to my comfort zone of a car payment. Yes, I would still need a loan but it would be much more affordable than something much newer. And car insurance would be more affordable too. What a huge sigh of relief!

Since I wasn't needing such a high loan, I was approved for the $6,500 I was looking to take out, despite my credit issues. Technically I paid $5750 for the car but I had to consider taxes and fees, fixing the brakes and few maintenance expenses. The dealer was willing to give her roughly $5,000 at best and the car values at up to $8,000.

So without further adieu, I am pleased to introduce you to my new car!

Meet Lloyd Christmas! Fitting name, as he is my Christmas present to myself, he's red, and Dumb and Dumber is one of the funniest classics of all time :)

Now Jamie is thrilled with her brand new Chevy Equinox and I am loving Lloyd. You can even imagine us doing a happy dance, jumping around the Chevy parking lot when we both got new cars!

It really was the best deal I could have found and I plan to run this car for as long as it will last. Now to navigate selling my old car and continuing with the spending challenge!!

Wednesday, November 5, 2014

When Life Hands You Lemons...

Thank you for all the advice and perspective on what car to buy. This is the first time I've been looking at buying a car and making the right choice is nearly paralyzing.

Here are the dirty deets on what I'm looking at, numbers wise. The most I'm comfortable paying on a monthly basis is $225/month. I can't emphasize enough how that is the absolute most I'm willing to pay and even the idea of that amount makes me want to throw up. I understand that is not a huge car payment compared to many but for my situation, that's where I'm at.

That averages out to a car loan of $10,000. When I look at used cars for $10,000 or less, it's nerve wracking. A car in that range will be older, roughly 2008 at best. And it will have a lot of miles, nearly 100,000 in most cases. By the time I paid off a 4 year loan, it would be time to get a new car. Stretching my budget and financial comfort zone so much while still driving a car that could come across several problems at any time just didn't feel ok. Even thinking about it now puts knots in my stomach.

However. If I bumped my budget up to $14,000 I could afford a 2013 car (used of course) with 40,000 miles. A car like that could last me 10 years at least. If I had a 4 year loan, I would have at least 6 years of no car payment. But that bumps my monthly payment up to $305. *Excuse me while I dry heave*

So this dilemma lead me to my last post where I simply don't know what to do. But then life made the decision for me.

I went over to a local credit union where I found the rate of 2.99% to get pre-approved. They dropped a big bomb on me that my credit is all screwed up from 2 unpaid bills that I never received. Apparently all my moving around has left a few bills that did not get forwarded. When a bill is mailed to you, you have 30 days to pay it. There is no legal requirement for them to call you or email you before it gets sent to collections. Who knew?

Between those hard credit hits and my high debt ratio with student loans, it puts me in the "maybe" category for qualifying for a loan. If I tested it and applied anyway, the poor credit would hurt the terms of my loan at best. At worst, I would not qualify and I would have another soft hit on my credit from the application. I guess that solves my problem before it began.

After a few incredibly frustrated Lauren Conrad tears, I called the collectors and got the bills paid from the parking lot of the credit union. The pleasant man named Mr. Royal explained that it will take 45 days for my credit to be redeemed. December 19th to be exact.

I am thankful my car still runs relatively well and I'm praying every day that my car works one more day as I get closer to December 19th. I think chances are good but as always with a 198,000 mile car, ya just never know. It helps that I've been listening to Amy Poehler's new book on CD so it makes me enjoy my time driving whenever necessary.

In the meantime, in true Katie fashion, I came up with a plan. The spending challenge is still completely in tact and in fact, even more important than ever. Instead of putting all my extra money towards debt, I will be saving every single penny I can find until December 19th. The goal is to save enough to get my expected loan amount down from $14,000 to as close to $10,000 as I can get. That way I can get a longer lasting car without going drastically over my comfortable monthly payment.

I'm expecting to save at least $2,000 with the hopes that it could be more. Whatever I can save myself now will ultimately reduce my monthly payments and leave room for extra money to go towards my student loans.

It bugs me that the spending challenge is being rerouted a bit. I hate that I'm tacking on more debt but I'm determined to get rid of it all one way or another. I am not giving up and trust me, I'm learning a lot along the way. I have to come to terms with the fact that I will be entering my 30's with debt, unless I win the lottery that I don't play.

So that's the scoop. The count is on and I'm being more frugal than ever to make this as painless of a blow as it needs to be. In fact, I found a quarter on the front walk and you bet I snatched that up!

Here are the dirty deets on what I'm looking at, numbers wise. The most I'm comfortable paying on a monthly basis is $225/month. I can't emphasize enough how that is the absolute most I'm willing to pay and even the idea of that amount makes me want to throw up. I understand that is not a huge car payment compared to many but for my situation, that's where I'm at.

That averages out to a car loan of $10,000. When I look at used cars for $10,000 or less, it's nerve wracking. A car in that range will be older, roughly 2008 at best. And it will have a lot of miles, nearly 100,000 in most cases. By the time I paid off a 4 year loan, it would be time to get a new car. Stretching my budget and financial comfort zone so much while still driving a car that could come across several problems at any time just didn't feel ok. Even thinking about it now puts knots in my stomach.

However. If I bumped my budget up to $14,000 I could afford a 2013 car (used of course) with 40,000 miles. A car like that could last me 10 years at least. If I had a 4 year loan, I would have at least 6 years of no car payment. But that bumps my monthly payment up to $305. *Excuse me while I dry heave*

So this dilemma lead me to my last post where I simply don't know what to do. But then life made the decision for me.

I went over to a local credit union where I found the rate of 2.99% to get pre-approved. They dropped a big bomb on me that my credit is all screwed up from 2 unpaid bills that I never received. Apparently all my moving around has left a few bills that did not get forwarded. When a bill is mailed to you, you have 30 days to pay it. There is no legal requirement for them to call you or email you before it gets sent to collections. Who knew?

Between those hard credit hits and my high debt ratio with student loans, it puts me in the "maybe" category for qualifying for a loan. If I tested it and applied anyway, the poor credit would hurt the terms of my loan at best. At worst, I would not qualify and I would have another soft hit on my credit from the application. I guess that solves my problem before it began.

After a few incredibly frustrated Lauren Conrad tears, I called the collectors and got the bills paid from the parking lot of the credit union. The pleasant man named Mr. Royal explained that it will take 45 days for my credit to be redeemed. December 19th to be exact.

I am thankful my car still runs relatively well and I'm praying every day that my car works one more day as I get closer to December 19th. I think chances are good but as always with a 198,000 mile car, ya just never know. It helps that I've been listening to Amy Poehler's new book on CD so it makes me enjoy my time driving whenever necessary.

In the meantime, in true Katie fashion, I came up with a plan. The spending challenge is still completely in tact and in fact, even more important than ever. Instead of putting all my extra money towards debt, I will be saving every single penny I can find until December 19th. The goal is to save enough to get my expected loan amount down from $14,000 to as close to $10,000 as I can get. That way I can get a longer lasting car without going drastically over my comfortable monthly payment.

I'm expecting to save at least $2,000 with the hopes that it could be more. Whatever I can save myself now will ultimately reduce my monthly payments and leave room for extra money to go towards my student loans.

It bugs me that the spending challenge is being rerouted a bit. I hate that I'm tacking on more debt but I'm determined to get rid of it all one way or another. I am not giving up and trust me, I'm learning a lot along the way. I have to come to terms with the fact that I will be entering my 30's with debt, unless I win the lottery that I don't play.

So that's the scoop. The count is on and I'm being more frugal than ever to make this as painless of a blow as it needs to be. In fact, I found a quarter on the front walk and you bet I snatched that up!

Monday, November 3, 2014

HELP - I need your advice!

Good morning, blog world!

I mentioned in my monthly update post that it's time to buy a new car. Unfortunately, that means I'm adding on a car payment in the midst of trying to get rid of debt. It's safe to say this is not a happy decision for me but unfortunately it is necessary.

As I look at what I can afford, I am completely torn. A newer, nicer, reliable car will likely last me 10-15 years, but it hits the max of my budget, which is already as tight as can be thanks to this spending challenge. This loan will last 3-4 years, which means I couldn't incur any further expenses for the next 3-4 years unless my income drastically improved and I would barely make a dent in additional debt payments with my paycheck alone.

However, if I look at an older car with higher mileage on it, it will cost me a few thousand less total but will likely only last 5 years max and the chances of it requiring repairs is obviously higher.

Thankfully, I have found a wonderful credit union who is offering 2.99% interest on any car loan I get, which is the best deal I've found so far. That's the only silver lining I have found so far.

I am frustrated to be adding to my debt when I am trying so hard to reduce it. I'm frustrated that I have worked several jobs for my entire adult life and yet I'm always pinching to make ends meet. I'm frustrated that in all my years of learning about finance, I'm still in this situation. There are so many times I could have been smarter and I'm kicking myself for not applying what I've learned. I'm scared that I will take on more debt, be in over my head and not be able to get myself out of it. I'm scared that I'll take out a loan and something horrible will happen to the car and I'll be in big trouble financially.

I am trying really hard to set aside my emotions and do the smart thing. But to be honest, I'm not sure what that is.

Have you bought a used car? What models are good? How much mileage is too much? What would you do??

I mentioned in my monthly update post that it's time to buy a new car. Unfortunately, that means I'm adding on a car payment in the midst of trying to get rid of debt. It's safe to say this is not a happy decision for me but unfortunately it is necessary.

As I look at what I can afford, I am completely torn. A newer, nicer, reliable car will likely last me 10-15 years, but it hits the max of my budget, which is already as tight as can be thanks to this spending challenge. This loan will last 3-4 years, which means I couldn't incur any further expenses for the next 3-4 years unless my income drastically improved and I would barely make a dent in additional debt payments with my paycheck alone.

However, if I look at an older car with higher mileage on it, it will cost me a few thousand less total but will likely only last 5 years max and the chances of it requiring repairs is obviously higher.

Thankfully, I have found a wonderful credit union who is offering 2.99% interest on any car loan I get, which is the best deal I've found so far. That's the only silver lining I have found so far.

I am frustrated to be adding to my debt when I am trying so hard to reduce it. I'm frustrated that I have worked several jobs for my entire adult life and yet I'm always pinching to make ends meet. I'm frustrated that in all my years of learning about finance, I'm still in this situation. There are so many times I could have been smarter and I'm kicking myself for not applying what I've learned. I'm scared that I will take on more debt, be in over my head and not be able to get myself out of it. I'm scared that I'll take out a loan and something horrible will happen to the car and I'll be in big trouble financially.

I am trying really hard to set aside my emotions and do the smart thing. But to be honest, I'm not sure what that is.

Have you bought a used car? What models are good? How much mileage is too much? What would you do??

Sunday, November 2, 2014

Spending Challenge: October Totals

October 1st Balances

Amex:

Mastercard: $5,714.27

Sallie Mae:

Chase: $19,907.33

Sallie Mae: $24,754.52

November 1st Balances

Amex:

Mastercard:

Sallie Mae:

Chase: $19,907.33

Sallie Mae: $24,754.52

That's a total of $2,088 this month!

I babysat (a lot!), wrote resumes, earned a bigger bonus at work, worked on Gradible.com, dog sat, and stuck to the spending challenge rules to make this possible. It takes some pretty serious effort to always prepare your meals or to pick up side jobs after a long work day but numbers like that are worth it.

The hardest part about the challenge this month was:

I got pretty overwhelmed one night thinking about how much debt I'm in. I got frustrated that I have been working at this goal for years and if I had done things differently, I could have been out of debt by now or at least much closer. I was annoyed that even with an entire year of this spending challenge, I will probably still have $40,000 in debt based on really rough estimates. It would take another 2 years of a spending challenge to be debt free. That really sucks.

Another challenge was having some serious car troubles. An entire post will be coming on this soon but long story short, I'll be buying a new (to me) car next week. Adding on a car loan was a big blow to my motivation and I ended up spending outside of my challenge as a result. However, it's a new month and I'm not giving up!

What I learned from the challenge this month was:

I had to change my perspective in order to be ok with this mountain I'm climbing. With this challenge, plus efforts down the road, I will still probably be debt free before 30. There's nothing I can do to fix the errors of my past but I can be proud that I am fixing issues that caused this debt and I'm working every day to get out of it. I am making some pretty big dents and if I take it one day at a time, I'll enjoy the little victories. After all, how do you eat an elephant? One bite at a time.

I also found that I was way to relaxed on my spending in October. I was so strict in September that I had plenty of money left over. As a result, I gave myself more freedom and it turned into too much. It feels a lot like the 3 bears - one month was too little, one month was too much, now this month will be juuuusst right, right??

The best part about the challenge this month was:

Looking at my finances when I realized I would need to factor in a car payment and seeing that I can make it work, thanks to the spending challenge. It will slow down my debt repayment but it doesn't completely ruin everything. If I were to have needed a car payment even 6 months ago, I would have been in big trouble!

2 months down, 10 to go!

Friday, October 10, 2014

How to pay off student loans faster

The spending challenge is still going strong and there are no signs of caving. It feels great to be making such progress! But I am a doer. My paychecks only come twice a month and my extra income does not result in daily payments to my debt. So the days in between can feel unproductive, even if not spending money is actually very beneficial to getting out of debt.

I was starting to get antsy that I won't be able to make another debt payment until payday next week. That feeling usually spirals into thinking if I can't make immediate progress, why not go spend money? I know it's not logical but impatience never is.

Thankfully, I came across a company called Gradible. They provide you with tasks that help local businesses in return for money that goes straight to your student loans! Tasks vary from writing content, like a blog post, to posting services to Craigslist. The tasks are worth LoanCreds, 100 LoanCreds = $10. Easy!

When I registered, 3 tasks in 30ish minutes and earned $16 off my student loans. It's not a ton of money but it can really add up and shrink your debt! It will especially help ward off those impatient feelings of not being able to immediately see numbers go down.

This is not a sponsored post by any means but I do believe in sharing how to pay off debt! If you want to do the same, sign up here and we'll both get $5 off our loans!

Have a great weekend!

I was starting to get antsy that I won't be able to make another debt payment until payday next week. That feeling usually spirals into thinking if I can't make immediate progress, why not go spend money? I know it's not logical but impatience never is.

Thankfully, I came across a company called Gradible. They provide you with tasks that help local businesses in return for money that goes straight to your student loans! Tasks vary from writing content, like a blog post, to posting services to Craigslist. The tasks are worth LoanCreds, 100 LoanCreds = $10. Easy!

When I registered, 3 tasks in 30ish minutes and earned $16 off my student loans. It's not a ton of money but it can really add up and shrink your debt! It will especially help ward off those impatient feelings of not being able to immediately see numbers go down.

This is not a sponsored post by any means but I do believe in sharing how to pay off debt! If you want to do the same, sign up here and we'll both get $5 off our loans!

Have a great weekend!

But what if you get a hole in your yoga pants?

As I explained the spending challenge to my friends, I told them I wasn't allowed to buy clothes for a whole year. One friend asked, "But what if you get a hole in your yoga pants or something you can't easily repair??"

Normally, if I got a hole in my beloved yoga pants I would have gone out and bought another pair. I would have found a Buy 1, Get 1 50% off coupon and then I have 2 new pairs of yoga pants. Did you know I already have several pairs? Same with jeans, sweaters, tank tops, shoes, dresses, etc.

I have enough clothes to not do laundry for probably 2 months without repeating outfits. It's ridiculous. Not only do all these clothes take up so much space but it takes forever to make a decision on what to wear each day. If I think jeans and a sweater sound good, that could still mean several variations. If a dress sounds good, I freeze debating a sun dress or maxi. And then what shoes go with what outfit??

I know this is typical girl stuff but it takes up a decent chunk of time each day making this relatively minor decision. And then I become late for work and rush myself into a decision that I don't even love sometimes.

Part of this spending challenge is focusing on my priorities. Spending money on clothes I don't need is certainly something I want to quit. I also want to get precious time back into my day that is normally wasted on clothes. Time wasted picking out outfits, loads of laundry, picking up the clothes all over my floor or putting laundry away. It's getting old.

Coincidentally, last week I did get a hole in my yoga pants. As stretchy as they are, thankfully it was not due to an expanding waistband. The seam caught on a filing cabinet and it split right down my thigh. The paperclip I used to keep my pants together made for a really cute look.

I thew them out when I got home and have easily been surviving with the other pairs I have.

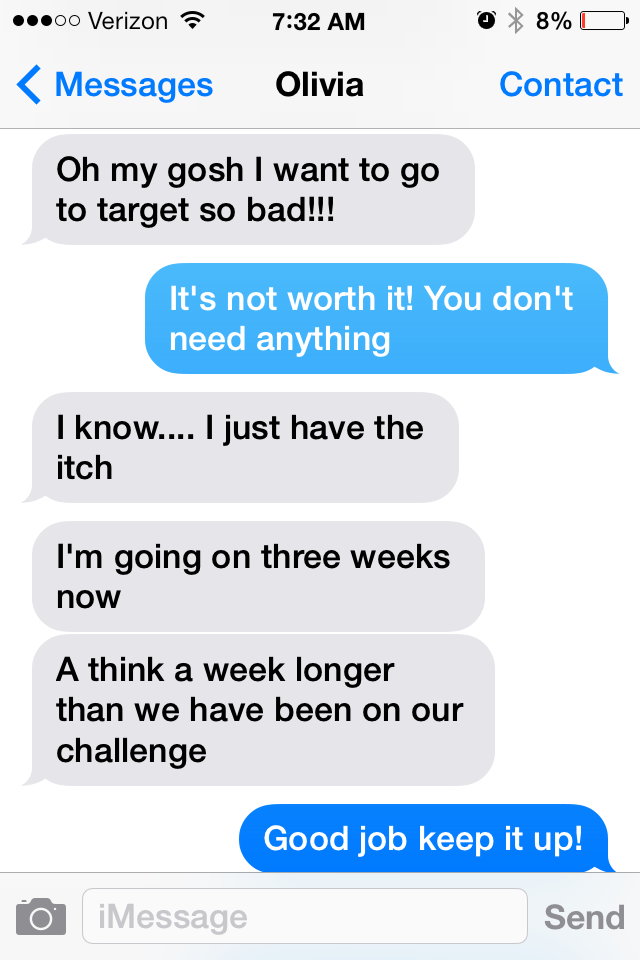

I'll admit that there are times when I get an email for a fall special on sweaters with a fairly good coupon attached. I'll admit that I've wanted to browse the racks of Target several times already for a few cute new additions. But when I look at my closet, I can't stand the idea of another hanger being used.

So now, if anything happens to my clothes, I can either sew them with my sewing machine or I can throw them out. After all, I have several backups of whatever item to last me through the year. There is nothing irreplaceable in my wardrobe that would absolutely require me to buy clothes during this challenge, with the exception of bridesmaid dresses, which are covered in my Bridesmaid fund.

I even want to downsize and donate a big bin to Good Will but I've been nervous because what if I get bored with my clothes this year and want to try some lesser worn outfits? But the simplistic approach will win me some time back in my day, which is worth a lot.

Normally, if I got a hole in my beloved yoga pants I would have gone out and bought another pair. I would have found a Buy 1, Get 1 50% off coupon and then I have 2 new pairs of yoga pants. Did you know I already have several pairs? Same with jeans, sweaters, tank tops, shoes, dresses, etc.

I have enough clothes to not do laundry for probably 2 months without repeating outfits. It's ridiculous. Not only do all these clothes take up so much space but it takes forever to make a decision on what to wear each day. If I think jeans and a sweater sound good, that could still mean several variations. If a dress sounds good, I freeze debating a sun dress or maxi. And then what shoes go with what outfit??

I know this is typical girl stuff but it takes up a decent chunk of time each day making this relatively minor decision. And then I become late for work and rush myself into a decision that I don't even love sometimes.

Part of this spending challenge is focusing on my priorities. Spending money on clothes I don't need is certainly something I want to quit. I also want to get precious time back into my day that is normally wasted on clothes. Time wasted picking out outfits, loads of laundry, picking up the clothes all over my floor or putting laundry away. It's getting old.

Coincidentally, last week I did get a hole in my yoga pants. As stretchy as they are, thankfully it was not due to an expanding waistband. The seam caught on a filing cabinet and it split right down my thigh. The paperclip I used to keep my pants together made for a really cute look.

I thew them out when I got home and have easily been surviving with the other pairs I have.

I'll admit that there are times when I get an email for a fall special on sweaters with a fairly good coupon attached. I'll admit that I've wanted to browse the racks of Target several times already for a few cute new additions. But when I look at my closet, I can't stand the idea of another hanger being used.

So now, if anything happens to my clothes, I can either sew them with my sewing machine or I can throw them out. After all, I have several backups of whatever item to last me through the year. There is nothing irreplaceable in my wardrobe that would absolutely require me to buy clothes during this challenge, with the exception of bridesmaid dresses, which are covered in my Bridesmaid fund.

I even want to downsize and donate a big bin to Good Will but I've been nervous because what if I get bored with my clothes this year and want to try some lesser worn outfits? But the simplistic approach will win me some time back in my day, which is worth a lot.

Tuesday, September 30, 2014

Spending Challenge: September Totals

I know I started on September 6th but I get paid on the 1st of each month so to make matters less complicated, I'm going to do my updates on the last day of the month. I will still finish on September 5th, 2015.

Starting Balances

Amex: $1,545.79

Mastercard: $5,714.27

Sallie Mae: $14,123.57

Chase: $19,907.33

Sallie Mae: $24,754.52

October 6th Balances

Amex:$1,545.79 $0

Mastercard: $5,714.27

Sallie Mae:$14,123.57 $11,472

Chase: $19,907.33

Sallie Mae: $24,754.52

That's a total of $4,518.32 this month! Doesn't that $0 balance look pretty??

I dog sat, babysat, wrote resumes, received bonuses at work, sold my kayak, received an inheritance, found plenty of affordable activities and stuck to the spending challenge rules to make this happen. This is certainly an abnormal month because I won't always have large items to sell and an inheritance doesn't happen every day. The momentum from this month has been incredible though!

Side note: Normally I would follow Dave Ramsey's snowball strategy and I would have made a dent in my Mastercard. However, the money from the inheritance was given to me by my parents who wanted to support my school debt. Understandably, they didn't want the money to pay off my excessive Target trips ;) Any debt payment going forward will follow the snowball plan.

The hardest part about the challenge this month was: Honestly, it was hard to find a challenge this month. It wasn't always my preference to prep my meals and plan ahead to avoid eating out. But with my food budget, I was able to get a meal or two out without consequence. I suppose you could say I easily would have bought clothes from Target over the past few weeks. Their fall lines looked adorable and definitely my style. Occasionally people were busy doing things that cost more money than I wanted to spend. It left me doing activities solo on occasion, which isn't always fun. The mindset that this challenge is going to make my life better made the challenges worth it. I have a feeling most months won't be this easy though!

What I learned from the challenge this month was: There are tons of free things to do and so many people are on board with doing more affordable activities! I was worried that people would count me out and drift away from our friendship if I wasn't able to spend money and that has certainly not been the case at all so far. I'm learning my insecurities were what was holding me back rather than reality. I learned that it feels great to set a goal and stick to it, rather than sway with any negative feedback of others.

For so long my goal has been to be out of debt and it has consumed me, unsuccessfully. I'm learning that it's not about the numbers. I know that when I'm 100% debt free, my life won't change all that much. I'll have less stress and more options financially, no doubt. But the people that love me will care for me either way.

One more lesson I learned - it was actually fairly easy to keep my spending money. By Sunday I still had $30 left. I splurged on Thai food delivered to my house. Ugh, the fees and tip alone cost $10. Looking back I'm bummed that I did it. I know in other months that $30 would really help. Lesson learned to save any leftover fun money for rainy days!

The best part about the challenge this month was: seeing how supportive people are. 95% of people I have talked to have been so encouraging and it makes this so much easier. Yes, seeing the $0 balance on my credit card felt pretty great and knowing I have less than $3,000 left in credit card debt is exciting. I honestly would have assumed that would have been the best part of the month.

1 month down, 11 to go! There are already some big things on the October schedule so I'm excited to see those numbers next month!

Starting Balances

Amex: $1,545.79

Mastercard: $5,714.27

Sallie Mae: $14,123.57

Chase: $19,907.33

Sallie Mae: $24,754.52

October 6th Balances

Amex:

Mastercard: $5,714.27

Sallie Mae:

Chase: $19,907.33

Sallie Mae: $24,754.52

That's a total of $4,518.32 this month! Doesn't that $0 balance look pretty??

I dog sat, babysat, wrote resumes, received bonuses at work, sold my kayak, received an inheritance, found plenty of affordable activities and stuck to the spending challenge rules to make this happen. This is certainly an abnormal month because I won't always have large items to sell and an inheritance doesn't happen every day. The momentum from this month has been incredible though!

Side note: Normally I would follow Dave Ramsey's snowball strategy and I would have made a dent in my Mastercard. However, the money from the inheritance was given to me by my parents who wanted to support my school debt. Understandably, they didn't want the money to pay off my excessive Target trips ;) Any debt payment going forward will follow the snowball plan.

The hardest part about the challenge this month was: Honestly, it was hard to find a challenge this month. It wasn't always my preference to prep my meals and plan ahead to avoid eating out. But with my food budget, I was able to get a meal or two out without consequence. I suppose you could say I easily would have bought clothes from Target over the past few weeks. Their fall lines looked adorable and definitely my style. Occasionally people were busy doing things that cost more money than I wanted to spend. It left me doing activities solo on occasion, which isn't always fun. The mindset that this challenge is going to make my life better made the challenges worth it. I have a feeling most months won't be this easy though!

What I learned from the challenge this month was: There are tons of free things to do and so many people are on board with doing more affordable activities! I was worried that people would count me out and drift away from our friendship if I wasn't able to spend money and that has certainly not been the case at all so far. I'm learning my insecurities were what was holding me back rather than reality. I learned that it feels great to set a goal and stick to it, rather than sway with any negative feedback of others.

For so long my goal has been to be out of debt and it has consumed me, unsuccessfully. I'm learning that it's not about the numbers. I know that when I'm 100% debt free, my life won't change all that much. I'll have less stress and more options financially, no doubt. But the people that love me will care for me either way.

One more lesson I learned - it was actually fairly easy to keep my spending money. By Sunday I still had $30 left. I splurged on Thai food delivered to my house. Ugh, the fees and tip alone cost $10. Looking back I'm bummed that I did it. I know in other months that $30 would really help. Lesson learned to save any leftover fun money for rainy days!

The best part about the challenge this month was: seeing how supportive people are. 95% of people I have talked to have been so encouraging and it makes this so much easier. Yes, seeing the $0 balance on my credit card felt pretty great and knowing I have less than $3,000 left in credit card debt is exciting. I honestly would have assumed that would have been the best part of the month.

1 month down, 11 to go! There are already some big things on the October schedule so I'm excited to see those numbers next month!

Monday, September 29, 2014

I could really get used to this spending challenge!

Another weekend in the books and the challenge is still going strong!

I had $30 left for food until my next paycheck so I ran to the grocery store for a few things to compliment what I had in my kitchen. Less than $20 I was out of there and ready to make some baked fajitas thanks to Pinterest.

I paired it with a tortilla shell I had on hand and some plain Greek yogurt because I am blessed to have taste buds that are fooled into thinking it's sour cream. I may have also paired it with the rest of my boxed wine and a night on the porch with my favorite single lady.

Saturday kicked off a new season with the organization I volunteer for. We teach Downs syndrome kids how to read and I was lucky enough to tutor two kids Saturday morning. These kids are the best and I love reading with them!

After being a responsible adult with a walk, lunch, shower, etc. it was time for some bridesmaid duties. One of my best friends from high school is getting married to her high school sweetheart and we picked out our bridesmaid dresses on Saturday. As a way to get to know the bridesmaids better, we also did dinner and went to Bar Louie in Uptown.

I love being a bridesmaid because I get to become friends with the bride's friends and it's super fun! These girls are hilarious so I'm really looking forward to the bachelorette party and the wedding!

As rounds of drinks were bought, the bride was worried that I would talk about how I spent too much money on my blog. Haha! I seriously love how invested in this challenge and supportive people are! I spent more than I would have on a night out with this challenge but I have a "bridesmaid" fund and it covered my bill :)

Sunday was a little rough after the night before but when Erika called me to go hiking, I was on board. The weather was perfect and the views at Afton Alps were beautiful.

It was way cheaper and more active than our normal brunch outing! I really love that we made that switch even if those hills showed how out of shape I am!

I finished the weekend with a Vikings win, getting some work done, and reading for book club. My budget is still completely on track with this challenge and I can't wait to give you the first month's official totals tomorrow! Spoiler alert - the results are good!

I had $30 left for food until my next paycheck so I ran to the grocery store for a few things to compliment what I had in my kitchen. Less than $20 I was out of there and ready to make some baked fajitas thanks to Pinterest.

I paired it with a tortilla shell I had on hand and some plain Greek yogurt because I am blessed to have taste buds that are fooled into thinking it's sour cream. I may have also paired it with the rest of my boxed wine and a night on the porch with my favorite single lady.

Saturday kicked off a new season with the organization I volunteer for. We teach Downs syndrome kids how to read and I was lucky enough to tutor two kids Saturday morning. These kids are the best and I love reading with them!

After being a responsible adult with a walk, lunch, shower, etc. it was time for some bridesmaid duties. One of my best friends from high school is getting married to her high school sweetheart and we picked out our bridesmaid dresses on Saturday. As a way to get to know the bridesmaids better, we also did dinner and went to Bar Louie in Uptown.

I love being a bridesmaid because I get to become friends with the bride's friends and it's super fun! These girls are hilarious so I'm really looking forward to the bachelorette party and the wedding!

As rounds of drinks were bought, the bride was worried that I would talk about how I spent too much money on my blog. Haha! I seriously love how invested in this challenge and supportive people are! I spent more than I would have on a night out with this challenge but I have a "bridesmaid" fund and it covered my bill :)

Sunday was a little rough after the night before but when Erika called me to go hiking, I was on board. The weather was perfect and the views at Afton Alps were beautiful.

It was way cheaper and more active than our normal brunch outing! I really love that we made that switch even if those hills showed how out of shape I am!

I finished the weekend with a Vikings win, getting some work done, and reading for book club. My budget is still completely on track with this challenge and I can't wait to give you the first month's official totals tomorrow! Spoiler alert - the results are good!

Monday, September 22, 2014

A very free weekend

Spending challenge days 14 and 15 complete! People often equate not spending money with sitting at home, being boring and doing nothing. That may be the case occasionally but this weekend was packed full of fun, free things.

Simply turn your head sideways to view pictures in this post because my computer is being ridiculous today.

Friday was relaxing. I cleaned, cooked and watched Season 1 of You're The Worst, a new hysterical show on FX. Part of my goal for this challenge is to spend more time keeping this organized and getting rid of crap. I took an old cork board that was sitting in my closet and turned it into a necklace rack. My jewelry has been sitting in a shoe box for a year now so it feels great to have it displayed better.

I still need to find a holder for my earings and bracelets but it's a good start!

Saturday I wrote some resumes, enjoyed a walk around Lake Calhoun, and explored my dream life at the Parade of Homes. One of the benefits of the spending challenge is to be in a better spot so I can buy a home so I used this as motivation. These houses were incredible and a cool $1.5 million.

By the 5th house I was starting to get depressed at how far out of reach these were so I headed home, just in time to beat a big storm. I headed to my friend's house to have a drink and watch Jim Gaffigan on Netflix to cheer us up.

Sunday was the best of all. I biked 5 miles to my friend's house, where we met to go hiking at Lebanon Hills. The weather was perfect and the 4-mile workout was fantastic.

Instead of doing our usual Sunday brunch at a cool Minneapolis restaurant, we made our own and it was freaking fantastic! Eggs Benedict, sweet potatoes, asparagus, salmon cakes, bloody mary's and champagne!

We didn't have to wait in line and we each spent less than $10 on the food and drinks. It was a big hit and I'm so glad the girls are on board to do it again! My friends are so supportive of this challenge and it's making a world of difference.

Afterward I had my bike adjusted before I rode back home because not only were the tires nearly flat but the seat was not adjusted to my height correctly. Thank God for friends who know a thing or two about bike riding!! All that exercise showed some great results for my Fitbit that I finally started using!

I ended the weekend with a Paint Nite event with my co-workers. I bought the Living Social deal a few weeks ago so my only expense was a glass of sangria, which I'm regretting since it was $9 that could have been spent in a better way.

Normally I would have picked a different night to go when we were painting a design I liked better but it was a team bonding event and I didn't get a say. Instead of making a painting of flowers that I would never actually hang in my house, I decided to go rogue and make a painting I actually might want. I'm certainly not a skilled painter and my idea became more ambitious that I was prepared for but I was able to cover it up with bold black lines. The instructor was a bit surprised I did something different but if I paid for the supplies, why not paint something I wanted?

It feels great to have another fun weekend without screwing up the challenge! Happy Monday!

Simply turn your head sideways to view pictures in this post because my computer is being ridiculous today.

Friday was relaxing. I cleaned, cooked and watched Season 1 of You're The Worst, a new hysterical show on FX. Part of my goal for this challenge is to spend more time keeping this organized and getting rid of crap. I took an old cork board that was sitting in my closet and turned it into a necklace rack. My jewelry has been sitting in a shoe box for a year now so it feels great to have it displayed better.

I still need to find a holder for my earings and bracelets but it's a good start!

Saturday I wrote some resumes, enjoyed a walk around Lake Calhoun, and explored my dream life at the Parade of Homes. One of the benefits of the spending challenge is to be in a better spot so I can buy a home so I used this as motivation. These houses were incredible and a cool $1.5 million.

By the 5th house I was starting to get depressed at how far out of reach these were so I headed home, just in time to beat a big storm. I headed to my friend's house to have a drink and watch Jim Gaffigan on Netflix to cheer us up.

Sunday was the best of all. I biked 5 miles to my friend's house, where we met to go hiking at Lebanon Hills. The weather was perfect and the 4-mile workout was fantastic.

Instead of doing our usual Sunday brunch at a cool Minneapolis restaurant, we made our own and it was freaking fantastic! Eggs Benedict, sweet potatoes, asparagus, salmon cakes, bloody mary's and champagne!

We didn't have to wait in line and we each spent less than $10 on the food and drinks. It was a big hit and I'm so glad the girls are on board to do it again! My friends are so supportive of this challenge and it's making a world of difference.

Afterward I had my bike adjusted before I rode back home because not only were the tires nearly flat but the seat was not adjusted to my height correctly. Thank God for friends who know a thing or two about bike riding!! All that exercise showed some great results for my Fitbit that I finally started using!

I ended the weekend with a Paint Nite event with my co-workers. I bought the Living Social deal a few weeks ago so my only expense was a glass of sangria, which I'm regretting since it was $9 that could have been spent in a better way.

Normally I would have picked a different night to go when we were painting a design I liked better but it was a team bonding event and I didn't get a say. Instead of making a painting of flowers that I would never actually hang in my house, I decided to go rogue and make a painting I actually might want. I'm certainly not a skilled painter and my idea became more ambitious that I was prepared for but I was able to cover it up with bold black lines. The instructor was a bit surprised I did something different but if I paid for the supplies, why not paint something I wanted?

It feels great to have another fun weekend without screwing up the challenge! Happy Monday!

Friday, September 19, 2014

Breathing is Expensive

Every fall I have to avoid bonfires, exercise, beer, and sometimes even just being outside. Although it's the most beautiful time of year, it's often the most stressful for me. As someone with chronic asthma, my lungs just can't take the season change and with very few exceptions, I end up in the ER in the middle of the night unable to breathe once or twice a September. It's been happening since 2nd grade and not only does it cramp my fall-loving style but it's expensive. Crazy expensive.

Depending on the year and how bad my asthma is, I end up paying $1,000-$4,000 in medical expenses every fall. That's not exactly budget friendly. And go figure, my asthma is also triggered by stress so worrying about that expense doesn't help anything.

This year, especially in line with the spending challenge, I knew I needed to be proactive. Not only did I not want my roommates to have to drive me to the ER in the middle of the night, I knew I wasn't wasting money on the ER. So I decided to be proactive. Every year, after the asthma attacks, my doctors would give me a preventative steroid inhaler. It finally clicked this year that I should use last year's after thought to be preventative this year!

As I picked up my meds yesterday, I learned that my preventative inhaler cost $191. I was appalled that it costs me $1.50 per puff but I would rather pay that than a medical bill and a ruined fall any day. And fortunately a fee like that can be covered with my HSA account, unlike a couple thousand in medical bills.

So I puff my Flovent inhaler and take an allergy pill every night and it's amazing the difference I have felt! I have exercised, I drink beer, I go on walks and I even had a bonfire last night! I might actually be able to enjoy this season we call fall! And best of all, I sleep through the night, full able to breathe with no coughing fits. I'm knocking on all of the wood and crossing my fingers, eyes, and toes that this solution sticks.

I'm learning that fairly minor changes like this is exactly what I was hoping the spending challenge would accomplish. I have yet to feel restricted or deprived, yet I already feel smarter about how my actions affect my financial situation.

Cheers to starting week 3 tomorrow!

Depending on the year and how bad my asthma is, I end up paying $1,000-$4,000 in medical expenses every fall. That's not exactly budget friendly. And go figure, my asthma is also triggered by stress so worrying about that expense doesn't help anything.

This year, especially in line with the spending challenge, I knew I needed to be proactive. Not only did I not want my roommates to have to drive me to the ER in the middle of the night, I knew I wasn't wasting money on the ER. So I decided to be proactive. Every year, after the asthma attacks, my doctors would give me a preventative steroid inhaler. It finally clicked this year that I should use last year's after thought to be preventative this year!

As I picked up my meds yesterday, I learned that my preventative inhaler cost $191. I was appalled that it costs me $1.50 per puff but I would rather pay that than a medical bill and a ruined fall any day. And fortunately a fee like that can be covered with my HSA account, unlike a couple thousand in medical bills.

So I puff my Flovent inhaler and take an allergy pill every night and it's amazing the difference I have felt! I have exercised, I drink beer, I go on walks and I even had a bonfire last night! I might actually be able to enjoy this season we call fall! And best of all, I sleep through the night, full able to breathe with no coughing fits. I'm knocking on all of the wood and crossing my fingers, eyes, and toes that this solution sticks.

I'm learning that fairly minor changes like this is exactly what I was hoping the spending challenge would accomplish. I have yet to feel restricted or deprived, yet I already feel smarter about how my actions affect my financial situation.

Cheers to starting week 3 tomorrow!

Tuesday, September 16, 2014

Going to the movies for FREE!

I once paid $14 for a movie ticket. Just the ticket without popcorn. As I mapped out my spending challenge, I was bummed to realize that I would likely have to quit going to the movies. With $50/month for fun, an expensive ticket + popcorn just wasn't going to happen.

I'm happy to report that although I've found that many local theaters have actually lowered their prices to $5-$8 per ticket (yay!), I've found ways to see movies for FREE!

Of course you can rent a movie through Redbox. You can easily find promo codes to get a free rental or a BOGO. Now, don't forget to return these DVDs or you will be charged the full price of the movie. Not that I would know...

If you don't want to wait until a movie comes out on DVD, I've found ways to see new releases in the theaters! If you still have your student ID, you can see if you college shows free movies a few weeks after the movie has been released. The University of Minnesota does that!

Best of all, you can even see movies in theaters BEFORE they've been released! Several sites, including Gofobo, promote free movie screenings the week before the movie comes out. You can typically Google to find an RSVP code or several local media outlets will promote RSVP codes and promotions as well.

So far I've seen The 100 Foot Journey and This Is Where I Leave You and they were both fantastic films!

The spending challenge is alive and well, thanks to opportunities like these! Do you have any tricks to seeing free movies?

I'm happy to report that although I've found that many local theaters have actually lowered their prices to $5-$8 per ticket (yay!), I've found ways to see movies for FREE!

Of course you can rent a movie through Redbox. You can easily find promo codes to get a free rental or a BOGO. Now, don't forget to return these DVDs or you will be charged the full price of the movie. Not that I would know...

If you don't want to wait until a movie comes out on DVD, I've found ways to see new releases in the theaters! If you still have your student ID, you can see if you college shows free movies a few weeks after the movie has been released. The University of Minnesota does that!

Best of all, you can even see movies in theaters BEFORE they've been released! Several sites, including Gofobo, promote free movie screenings the week before the movie comes out. You can typically Google to find an RSVP code or several local media outlets will promote RSVP codes and promotions as well.

So far I've seen The 100 Foot Journey and This Is Where I Leave You and they were both fantastic films!

The spending challenge is alive and well, thanks to opportunities like these! Do you have any tricks to seeing free movies?

Monday, September 15, 2014

Simple Minded

My sister and I are incredibly different people. Growing up, I always joked that I was adopted because we had nothing in common. As we've grown up, we have become closer and I'm thankful to find that a friendship has formed.

While she was visiting from England a few weeks ago, my sister helped me realize a new perspective and I'm looking forward to applying it to my spending challenge. I was frustrated about a group of people, claiming they were simple-minded. She looked at me and explained that she was simple minded, and that there was nothing wrong with it. I don't say this often, but my sister was right.

When someone asks me if they should spend money on going on a cruise when they're also saving for a wedding, I weigh the pros and cons and analyze every angle. I see it as gray area that can be adjusted to squeeze in every opportunity out of life. If someone were to ask my sister the same thing, she would see it as black and white. She would say no, save for the wedding. Focus on one thing, simple as that.

This spending challenge aligns well with a more simple-minded approach. In fact, talking with my sister solidified this plan after months or even years of considering it. No more justifying purchases or debating how I can spend a little more money. When the allowance is gone, it's gone until the following month. One goal in mind and the rest is background noise until I've met my goal. Black and white.

While she was visiting from England a few weeks ago, my sister helped me realize a new perspective and I'm looking forward to applying it to my spending challenge. I was frustrated about a group of people, claiming they were simple-minded. She looked at me and explained that she was simple minded, and that there was nothing wrong with it. I don't say this often, but my sister was right.

When someone asks me if they should spend money on going on a cruise when they're also saving for a wedding, I weigh the pros and cons and analyze every angle. I see it as gray area that can be adjusted to squeeze in every opportunity out of life. If someone were to ask my sister the same thing, she would see it as black and white. She would say no, save for the wedding. Focus on one thing, simple as that.

This spending challenge aligns well with a more simple-minded approach. In fact, talking with my sister solidified this plan after months or even years of considering it. No more justifying purchases or debating how I can spend a little more money. When the allowance is gone, it's gone until the following month. One goal in mind and the rest is background noise until I've met my goal. Black and white.

Friday, September 12, 2014

1 week down - 51 to go!

I assumed the first week would be full of adjustments. Always preparing my meals, avoiding expensive activities, etc. But honestly, it has barely phased me. Sure, there has been one or two unusual meals by eating whatever I had on hand, but I've stayed busy enough to not worry about it too much.

It's been a very busy week with work and volunteering so I haven't had any opportunities to pass on fun, costly activities or feel deprived of anything. The only expense I had this week was attending a networking event. $5 to attend, $3 to park. I had appetizers (included) and I passed on buying myself a drink. It felt odd to not have a glass of wine in my hand but I didn't miss it too much.

My co-worker had a Buy One, Get One at Noodles & Co and offered to take me out to lunch. She knows I can go to lunch, I just can't buy my lunch. It was so nice that she thought of me and was supportive of my spending challenge that I set aside any pride of her "buying" me lunch.

I used this week to tackle a few things I had been putting off, like selling my kayak and organizing the finances for my resume business. I was able to sell my kayak to a 12-year-old boy who had saved his money for 2 years to buy a kayak! And I hadn't taken a profit from my business all year (I'm still learning about this small business stuff!) so I finally paid myself a portion of this year's profit. So far I've been able to make a decent dent in my smallest credit card and it feels amazing. I'm already excited to share my Month 1 totals!

Here's hoping every week is this easy :) Week 1 down, 51 more weeks to go!

It's been a very busy week with work and volunteering so I haven't had any opportunities to pass on fun, costly activities or feel deprived of anything. The only expense I had this week was attending a networking event. $5 to attend, $3 to park. I had appetizers (included) and I passed on buying myself a drink. It felt odd to not have a glass of wine in my hand but I didn't miss it too much.

My co-worker had a Buy One, Get One at Noodles & Co and offered to take me out to lunch. She knows I can go to lunch, I just can't buy my lunch. It was so nice that she thought of me and was supportive of my spending challenge that I set aside any pride of her "buying" me lunch.

I used this week to tackle a few things I had been putting off, like selling my kayak and organizing the finances for my resume business. I was able to sell my kayak to a 12-year-old boy who had saved his money for 2 years to buy a kayak! And I hadn't taken a profit from my business all year (I'm still learning about this small business stuff!) so I finally paid myself a portion of this year's profit. So far I've been able to make a decent dent in my smallest credit card and it feels amazing. I'm already excited to share my Month 1 totals!

Here's hoping every week is this easy :) Week 1 down, 51 more weeks to go!

Monday, September 8, 2014

Just another day

I had a fantastic weekend, filled with friends, family, side jobs, and FOOTBALL (Go Vikings)! Oh, and I started my spending challenge on Saturday. September 6th marked the big day and to be honest, it felt like just another day.

The weather was gorgeous so I took my dog-sitting pups on a walk, I spent time with my friends, I helped a client with his resume, I enjoyed babysitting a crazy 2-year-old and I read for book club. Not only did I avoid spending, I made money too! The only slight difference was that I had to think ahead a little more on what food I ate to avoid buying coffee or fast food. Easy enough.

I'm thankful for friends (and readers!) who are supportive of my spending challenge. I'm relieved that they not only remind me of fun free activities but they don't complain or try to convince me to join them in costly activities.

My goal is to make progress without completely disrupting my whole life and making this unsustainable. And so far, so very good. Yes, it's only been two days but I don't feel like life has changed all that much, and I usually forget I'm not spending money. I didn't want this challenge to consume me and it turns out it's not, yet.

I'm already prepared to make my first debt payment while on this challenge after the money I made this weekend. It feels great to see that pesky debt shrink and I'm excited to see my monthly totals! I cannot wait to see how little I'll owe by September 6, 2015! Cheers to day 3!

The weather was gorgeous so I took my dog-sitting pups on a walk, I spent time with my friends, I helped a client with his resume, I enjoyed babysitting a crazy 2-year-old and I read for book club. Not only did I avoid spending, I made money too! The only slight difference was that I had to think ahead a little more on what food I ate to avoid buying coffee or fast food. Easy enough.

I'm thankful for friends (and readers!) who are supportive of my spending challenge. I'm relieved that they not only remind me of fun free activities but they don't complain or try to convince me to join them in costly activities.

My goal is to make progress without completely disrupting my whole life and making this unsustainable. And so far, so very good. Yes, it's only been two days but I don't feel like life has changed all that much, and I usually forget I'm not spending money. I didn't want this challenge to consume me and it turns out it's not, yet.

I'm already prepared to make my first debt payment while on this challenge after the money I made this weekend. It feels great to see that pesky debt shrink and I'm excited to see my monthly totals! I cannot wait to see how little I'll owe by September 6, 2015! Cheers to day 3!

Wednesday, September 3, 2014

One Year : A Challenge

A storm has been brewing lately. One of those awesome lightning storms that make amazing pictures and you sit in your garage watching it. The kind where you want to run out and dance in the pouring rain. A storm I'm kind of excited about.

I am doing something drastic to get out of debt. It's going to stir things up and create some big change. I will no longer be clueless. And it won't be easy.

In college, someone sent me a link to a Spending Fast® from Anna at And Then I Saved.

I was inspired but I never felt confident enough that I, too, could pull it off. You see, it requires a FULL YEAR of not spending outside of the necessary. She even learned how to cut her own hair. Seriously. And $24,000 later, she was out of debt.

It's been a few years since Anna coined the phrase "Spending Fast" and she has helped an entire community of people tackle their debt. Go read everyone's Get Out Of Debt Pledge - it blows my mind how many people are in my same shoes. I've stayed up to date on her blog and it continues to inspire me, even though I've never acted on it.

More recently, Cait from Blonde on a Budget started a year-long shopping ban too. While she is not in debt anymore, due to her incredible hard work and persistence, she knows that changing her habits will help her accomplish bigger dreams. I relate to that 100%. Cait admits she's terrified of "living without" and I share her concerns for my challenge.

With the inspiration and information these ambitious women and many others have provided, I'm joining the club. September 6th, 2014 is the official start of my spending challenge. And like most challenges, I have to set some rules to follow.

What I CAN spend money on:

I will have regular updates at the end of each pay period throughout this challenge to talk about how I stretch my $50 allowance and my debt payment totals. I don't have a specific amount of debt I expect to get rid of and I'm aware that I probably won't be entirely debt free next September. However, I'm really excited to see what the monthly and final numbers are.

Call me crazy but I'm actually a little excited for September 6th!

I am doing something drastic to get out of debt. It's going to stir things up and create some big change. I will no longer be clueless. And it won't be easy.

In college, someone sent me a link to a Spending Fast® from Anna at And Then I Saved.

I was inspired but I never felt confident enough that I, too, could pull it off. You see, it requires a FULL YEAR of not spending outside of the necessary. She even learned how to cut her own hair. Seriously. And $24,000 later, she was out of debt.

It's been a few years since Anna coined the phrase "Spending Fast" and she has helped an entire community of people tackle their debt. Go read everyone's Get Out Of Debt Pledge - it blows my mind how many people are in my same shoes. I've stayed up to date on her blog and it continues to inspire me, even though I've never acted on it.

More recently, Cait from Blonde on a Budget started a year-long shopping ban too. While she is not in debt anymore, due to her incredible hard work and persistence, she knows that changing her habits will help her accomplish bigger dreams. I relate to that 100%. Cait admits she's terrified of "living without" and I share her concerns for my challenge.

With the inspiration and information these ambitious women and many others have provided, I'm joining the club. September 6th, 2014 is the official start of my spending challenge. And like most challenges, I have to set some rules to follow.

What I CAN spend money on:

- Rent

- Gas ($120 per paycheck)

- Groceries ($150 per paycheck - includes any liquor store purchases)

- Basic Household Items

- Toilet paper, meal storage, cleaning products, laundry detergent, etc.

- Toiletries

- Makeup (only refills of what I currently use), shampoo, razors, etc.

- Utilities

- Does not include cable but does allow Internet, Netflix and Hulu subscriptions

- A new pair of Ugg boots (Minnesota winters, enough said)

- One pair of winter work shoes

- Mandatory car maintenance and repair

- A minimal phone upgrade - it's time after 2 years

- $75 per paycheck for savings - to be used for emergencies and bridesmaid expenses only

- $50 monthly allowance - this is to exclusively buy gifts or experiences, not things

- Clothes and shoes (with above exceptions)

- Books

- Unnecessary household items and decorations, including flowers

- Activities and gifts outside of my $50 monthly allowance - when it's gone, it's gone

- Buying a dog

- Electronics

- Donations to charities - I have donated as much as I can in the past and I will do much more after this challenge

- Plane tickets!

- Unnecessary cosmetics and luxuries (spray tans, teeth whitening, nail polish, manicures/pedicures, massages etc.)

- Cable

- Gym equipment or additional memberships - my current membership is already paid for 2.5 more years.

- Office supplies

I will have regular updates at the end of each pay period throughout this challenge to talk about how I stretch my $50 allowance and my debt payment totals. I don't have a specific amount of debt I expect to get rid of and I'm aware that I probably won't be entirely debt free next September. However, I'm really excited to see what the monthly and final numbers are.

Call me crazy but I'm actually a little excited for September 6th!

Tuesday, September 2, 2014

Failure is not Fatal

I've started spending challenges before. Quite a few of them, in fact.

Some have been more successful than others but none of them have been

completed for one reason or another.

I've had excuse after excuse for why I haven't been more proactive

about my debt. Sure, I've had intentions, obviously it's all I write

about, but my words have always spoken louder.

“The brick walls are there for a reason. The brick walls are not there to keep us out. The brick walls are there to give us a chance to show how badly we want something. Because the brick walls are there to stop the people who don’t want it badly enough. They’re there to stop the other people.”

― Randy Pausch, The Last Lecture

Brick walls (excuses) I've used to stay in debt:

- I need all of the things from Target. I couldn't possibly give up Target!

- I wouldn't have a social life and I would miss out on everything

- My friends would think I am lame and stop inviting me to things

- I would be so bored and lonely

- If I gave up unnecessary spending, it still wouldn't make much difference in my debt to be worth it

- Chipotle is way too good

- I don't want to be too consumed with all the sacrifice and put too much pressure on myself

- My schedule is too busy to give up convenience and make all my meals

- There's no way I would skip buying presents for birthdays or Christmas or donating to charities

- I have to travel to visit my friends and family or take advantage of cool opportunities!

- "I could really go for a drink, or pizza, or pad Thai right now," which always turns into ordering more.

Lincoln was a champion and he never gave up. Here is a sketch of Lincoln's road to the White House:

Getting out of debt is a big task, sure. But it's certainly not Earth shattering and it won't be the singular action that changes the world. I'm not the first to get out of debt and I won't be the last. So there really should be no reason to say "I can't." I have no good reason not to get myself into a better financial situation.

Well, Winston, I'm ready to try again with more confidence than ever. My current challenge isn't technically over yet. I haven't set foot in a Target and I've avoided buying clothes and eating out 95% of the time. However, I've spent alittle bit decent amount with my sister in town. Although it hasn't been

perfect, it's been my best shot yet. I want to keep that momentum going

and see what I'm really capable of.

Stay tuned for the official plan tomorrow!

- 1816: His family was forced out of their home. He had to work to support them.

- 1818: His mother died.

- 1831: Failed in business.

- 1832: Ran for state legislature - lost.

- 1832: Also lost his job - wanted to go to law school but couldn’t get in.

- 1833: Borrowed some money from a friend to begin a business and by the end of the year he was bankrupt. He spent the next

17 years of his life paying off this debt. - 1834: Ran for state legislature again - won.

- 1835: Was engaged to be married, sweetheart died and his heart was broken.

- 1836: Had a total nervous breakdown and was in bed for six months.

- 1838: Sought to become speaker of the state legislature - defeated.

- 1840: Sought to become elector - defeated.

- 1843: Ran for Congress - lost.

- 1846: Ran for Congress again - this time he won - went to Washington and did a good job.

- 1848: Ran for re-election to Congress - lost.

- 1849 Sought the job of land officer in his home state - rejected.

- 1854: Ran for Senate of the United States - lost.

- 1856: Sought the Vice-Presidential nomination at his party’s national convention - got less than

100 votes. - 1858: Ran for U.S. Senate again - again he lost.

- 1860: Elected president of the United States.